SEC Completes Inflation Adjustment Under Titles I And III Of The Jobs Act; Adopts Technical Amendments

On March 31, 2017, the SEC adopted several technical amendments to rules and forms under both the Securities Act of 1933 (“Securities Act”) and Securities Exchange Act of 1934 (“Exchange Act”) to conform with Title I of the JOBS Act. On the same day, the SEC made inflationary adjustments to provisions under Title I and Title III of the JOBS Act by amending the definition of the term “emerging growth company” and the dollar amounts in Regulation Crowdfunding.

Title I of the JOBS Act, initially enacted on April 5, 2012, created a new category of issuer called an “emerging growth company” (“EGC”). The primary benefits to an EGC include scaled-down disclosure requirements both in an IPO and periodic reporting, confidential filings of registration statements, certain test-the-waters rights in IPO’s, and an ease on analyst communications and reports during the EGC IPO process. For a summary of the scaled disclosure available to an EGC as well as the differences in disclosure requirements between an EGC and a smaller reporting company, see HERE.

As a reminder, the definition of an EGC as enacted on April 5, 2012 (i.e., not including the new inflationary adjustment discussed in this blog) is a company with total annual gross revenues of less than $1 billion during its most recently completed fiscal year that first sells equity in a registered offering after December 8, 2011. An EGC loses its EGC status on the earlier of (i) the last day of the fiscal year in which it exceeds $1 billion in revenues; (ii) the last day of the fiscal year following the fifth year after its IPO (for example, if the issuer has a December 31 fiscal year-end and sells equity securities pursuant to an effective registration statement on May 2, 2016, it will cease to be an EGC on December 31, 2021); (iii) the date on which it has issued more than $1 billion in non-convertible debt during the prior three-year period; or (iv) the date it becomes a large accelerated filer (i.e., its non-affiliated public float is valued at $700 million or more). EGC status is not available to asset-backed securities issuers (“ABS”) reporting under Regulation AB or investment companies registered under the Investment Company Act of 1940, as amended. However, business development companies (BDC’s) do qualify.

The provisions of Title I of the JOBS Act were self-executing and automatically became effective on April 5, 2012. Although the SEC has passed several rules and made numerous form amendments to conform to the JOBS Act provisions, several of the rules and forms under the Securities Act, Exchange Act, periodic and current reports forms, Regulation S-K and Regulation S-X did not reflect the JOBS Act provisions.

The statutory definition of an EGC, as reflected in Securities Act Section 2(a)(10) and Exchange Act Section 3(a)(80), require the SEC to make an adjustment to index to inflation the annual gross revenue amount used to determine an EGC, every five years.

Likewise, Title III of the JOBS Act, which set the statutory groundwork for Regulation Crowdfunding, requires an inflationary adjustment to the dollar figures in Regulation Crowdfunding every five years. On March 31, 2017, the SEC did so for the first time.

Inflation Adjustments

Definition of “Emerging Growth Company”

The JOBS Act amended Section 2(a)(19) of the Securities Act and Section 3(a)(80) of the Exchange Act to define an “emerging growth company” to mean a company with total annual gross revenues of less than $1 billion, as adjusted for inflation every 5 years, during its most recently completed fiscal year that first sells equity in a registered offering after December 8, 2011.

The SEC is now making its first inflationary increase to the definition. The inflation increase is $70,000. Accordingly, an EGC is now defined as a company with total gross revenues of less than $1,070,000,000.

Regulation Crowdfunding Amendments

Title III of the JOBS Act, enacted in April 2012, amended the Securities Act to add Section 4(a)(6) to provide an exemption for crowdfunding offerings. Regulation Crowdfunding went into effect on May 16, 2016. For a summary of the provisions, see HERE. The Securities Act requires that the amounts set forth in Regulation Crowdfunding be adjusted by the SEC for inflation not less than once every five years. The SEC is now making its first inflationary increase by amending Rules 100 and 201(t) of Regulation Crowdfunding and Securities Act Form C. The inflation increase is $70,000.

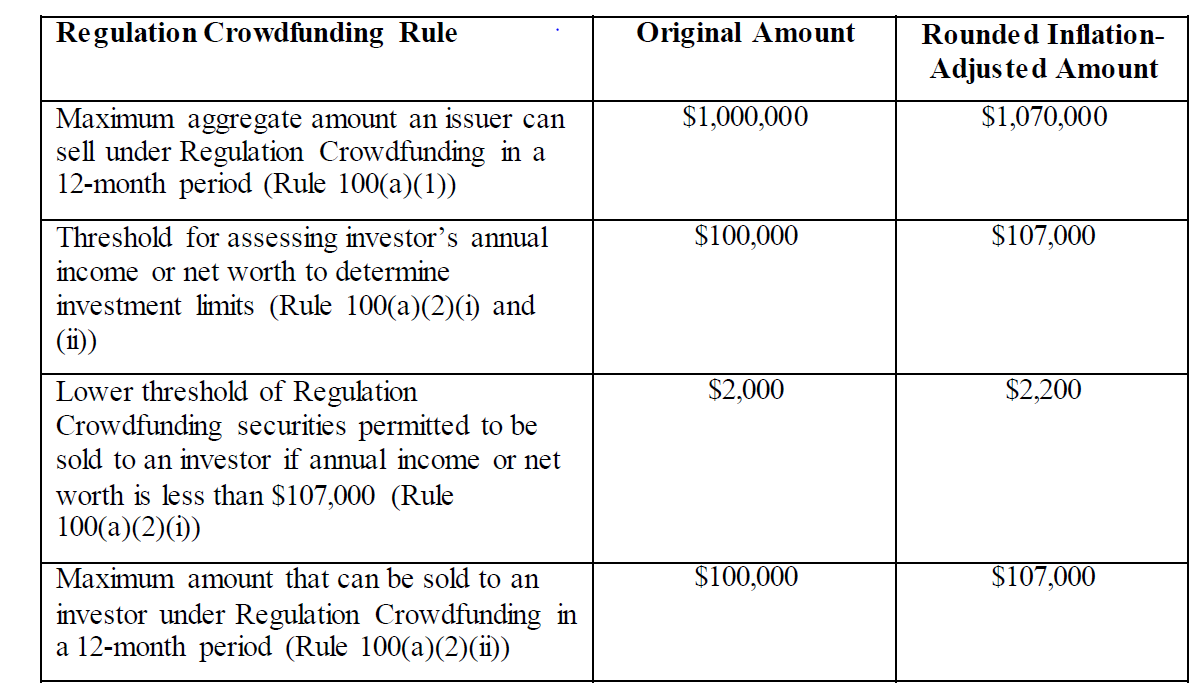

The new offering amount and investment limits are as follows:

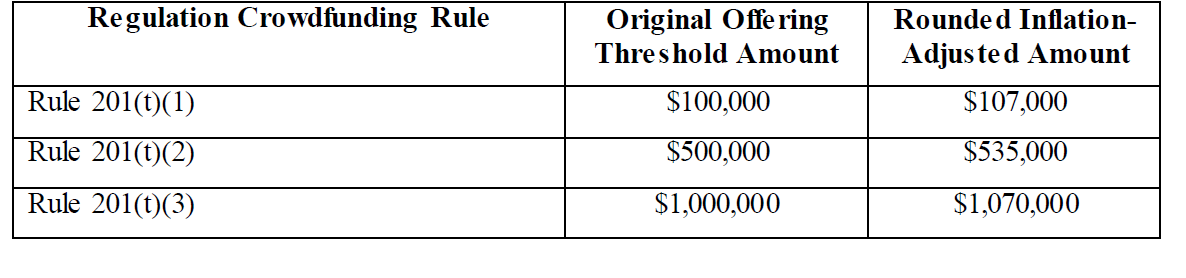

The new financial statement requirement thresholds are as follows:

Technical Amendments to Rules and Forms

Technical Amendments to Rules and Forms

Scaled Disclosure in Registration Forms and Periodic Reports

Section 102(b)(1) of the JOBS Act amended Section 7(a) of the Securities Act to provide that (1) an EGC is permitted to present only two years of audited financial statements in its IPO registration statement, and (2) in any Securities Act registration statement other than its IPO registration statement, an EGC need not present selected financial data under Item 301 of Regulation S-K for any period prior to the earliest audited period presented in its IPO registration statement. However, Item 301 and Rule 3-02 of Regulation S-X and Form 20-F had not been amended for these changes and, until now, contained conflicting requirements. In particular, such rules and forms only addressed reduced disclosure requirements for smaller reporting companies and not address the JOBS Act rules related to EGC’s. The SEC is now amending Item 301 and Rule 3-02 of Regulation S-X and Form 20-F to conform with Section 7(a) of the Securities Act.

Section 102(b)(2) of the JOBS Act amended Section 13(a) of the Exchange Act to provide that an EGC need not present selected financial data in an Exchange Act registration statement or periodic report for any period prior to the earliest audited period presented in the EGC’s first effective registration statement under either the Exchange Act or Securities Act. The SEC is now amending Item 301 of Regulation S-X to conform with Section 13(a) of the Exchange Act.

Likewise, the SEC is amending Item 303 of Regulation S-K related to management discussion and analyses (MD&A) such that a disclosure needs only to be provided for the periods of the financial statements included in the EGC’s IPO registration statement.

Auditor Attestation; Section 404(b) of Sarbanes-Oxley

Section 103 amended Section 404(b) of the Sarbanes-Oxley Act to exempt EGC’s from the need to provide an auditor attestation on management’s assessment of the effectiveness of the EGC’s internal controls over financial reporting. Compliance with Section 404(b) is very expensive, with the average cost being in the $2 million range. To conform with SEC rules and forms to amended Section 404(b), the SEC has amended Article 2-02 of Regulation S-X, Item 308 of Regulation S-K, and Forms 20-F and 40-F to specify that the auditor of an EGC does not need to attest to, and report on, management’s report on internal control over financial reporting and that management does not need to include the auditor’s attestation report in an annual report required by Section 13(a) or 15(d) of the Exchange Act.

Executive Compensation Disclosure and Shareholder Advisory Vote

Section 102(c) of the JOBS Act provides that an EGC need only provide the same executive compensation disclosure as a smaller reporting company. The smaller reporting company executive compensation disclosures are delineated in Items 402(m)-(r) of Regulation S-K. The SEC is amending Item 402 to specify that these scaled disclosures also apply to EGC’s.

Exchange Act Rule 14a-21 requires companies to conduct shareholder advisory votes on say-on-pay, say-on-frequency and golden parachute compensation arrangements with any “named executive officers.” Item 102(a) of the JOBS Act amended Section 14A(e) of the Exchange Act to exempt EGC’s from these requirements. The SEC is amending Exchange Act Rule 14a-21 and Item 402(t) and Instruction 1 to Item 1011(b) of Regulation S-K to conform with this statutory exemption. For more on say-on-pay, say-on-frequency and golden parachute compensation disclosures, see HERE.

Foreign Private Issuers

The definition of an emerging growth company is not dependent on whether the company is domestic or qualifies as a foreign private issuer. A foreign private issuer that qualifies as an EGC may avail itself of the scaled disclosures to the same extent as domestic companies. The SEC is now amending Form 20-F to conform its disclosure requirements with those available to an EGC.

“Check Box” Notice of EGC Status and Compliance with New or Revised Accounting Standards

Section 102(b) of the JOBS Act amended Section 7(a)(2)(B) of the Securities Act and Section 13(a) of the Exchange Act such that an EGC is not required to comply with new or revised financial accounting standards until private companies are also required to comply with those standards. An EGC can, however, choose to comply with such new or revised accounting standards but must do so on the next report or registration statement and notify the SEC of its choice. The election is irrevocable. To provide a method to inform the SEC of its choice, the SEC is adding a “check box” to Securities Act Forms S-1, S-3, S-4, S-8, S-11, F-1, F-3 and F-4 and Exchange Act Forms 10, 8-K, 10-Q, 10–K, 20–F and 40-F.

Click Here To Print- PDF Printout SEC Completes Inflation Adjustment Under Titles I And III Of The Jobs Act; Adopts Technical Amendments

The Author

Laura Anthony, Esq.

Founding Partner

Legal & Compliance, LLC

Corporate, Securities and Going Public Attorneys

330 Clematis Street, Suite 217

West Palm Beach, FL 33401

Phone: 800-341-2684 – 561-514-0936

Fax: 561-514-0832

LAnthony@LegalAndCompliance.com

www.LegalAndCompliance.com

www.LawCast.com

Securities attorney Laura Anthony and her experienced legal team provides ongoing corporate counsel to small and mid-size private companies, OTC and exchange traded issuers as well as private companies going public on the NASDAQ, NYSE MKT or over-the-counter market, such as the OTCQB and OTCQX. For nearly two decades Legal & Compliance, LLC has served clients providing fast, personalized, cutting-edge legal service. The firm’s reputation and relationships provide invaluable resources to clients including introductions to investment bankers, broker dealers, institutional investors and other strategic alliances. The firm’s focus includes, but is not limited to, compliance with the Securities Act of 1933 offer sale and registration requirements, including private placement transactions under Regulation D and Regulation S and PIPE Transactions as well as registration statements on Forms S-1, S-8 and S-4; compliance with the reporting requirements of the Securities Exchange Act of 1934, including registration on Form 10, reporting on Forms 10-Q, 10-K and 8-K, and 14C Information and 14A Proxy Statements; Regulation A/A+ offerings; all forms of going public transactions; mergers and acquisitions including both reverse mergers and forward mergers, ; applications to and compliance with the corporate governance requirements of securities exchanges including NASDAQ and NYSE MKT; crowdfunding; corporate; and general contract and business transactions. Moreover, Ms. Anthony and her firm represents both target and acquiring companies in reverse mergers and forward mergers, including the preparation of transaction documents such as merger agreements, share exchange agreements, stock purchase agreements, asset purchase agreements and reorganization agreements. Ms. Anthony’s legal team prepares the necessary documentation and assists in completing the requirements of federal and state securities laws and SROs such as FINRA and DTC for 15c2-11 applications, corporate name changes, reverse and forward splits and changes of domicile. Ms. Anthony is also the author of SecuritiesLawBlog.com, the OTC Market’s top source for industry news, and the producer and host of LawCast.com, the securities law network. In addition to many other major metropolitan areas, the firm currently represents clients in New York, Las Vegas, Los Angeles, Miami, Boca Raton, West Palm Beach, Atlanta, Phoenix, Scottsdale, Charlotte, Cincinnati, Cleveland, Washington, D.C., Denver, Tampa, Detroit and Dallas.

Contact Legal & Compliance LLC. Technical inquiries are always encouraged.

Follow me on Facebook, LinkedIn, YouTube, Google+, Pinterest and Twitter.

Legal & Compliance, LLC makes this general information available for educational purposes only. The information is general in nature and does not constitute legal advice. Furthermore, the use of this information, and the sending or receipt of this information, does not create or constitute an attorney-client relationship between us. Therefore, your communication with us via this information in any form will not be considered as privileged or confidential.

This information is not intended to be advertising, and Legal & Compliance, LLC does not desire to represent anyone desiring representation based upon viewing this information in a jurisdiction where this information fails to comply with all laws and ethical rules of that jurisdiction. This information may only be reproduced in its entirety (without modification) for the individual reader’s personal and/or educational use and must include this notice.

© Legal & Compliance, LLC 2017

« SEC Adopts The T+2 Trade Settlement Cycle The Senate Banking Committee Passes Several Pro-Business Bills »